Chinese innovative drug R&D trends in 2024

来源:Nature | 发布时间:2024-08-19

Supplementary Box 1 | Data and analysis

The data on China’s domestic novel drug pipelines were gathered from the Pharmcube database, which compiles information from a variety of sources, including China’s Registration and Information Disclosure Platform for Drug Clinical Studies, Chinese Clinical Trial Register (ChiCTR), ClinicalTrials.gov clinical trial registries, scientific conferences,company press releases, published reports and investor presentations, among others.

Our analysis included investigational therapeutics and vaccines aimed at treating or preventing diseases, excluding generic drugs or biosimilars. The included products were either discovered de novo in China or were products that were in-licensed by Chinese companies that entered clinical development but had not received marketing authorization in any country by 1 January 2024. Products no longer being actively developed were excluded. A total of 4,391 candidates were included in this analysis.

To track the evolution of China’s innovative drug landscape, we performed a comprehensive comparison between the data for the current analysis (with a data cut-off of 1 January 2024) and the data for our previous analysis1 (with a data cut-off of 1 July 2021). Following methods similar to the previous analysis1, data were manually verified and categorized according to parameters of target, product type, innovation level, most advanced development stage for any indication in China and abroad, indications, and location of origin. Some product information might not be publicly available, which could affect the classification of individual products.

In terms of product type, candidates were initially classified as small molecules, monoclonal antibodies (mAbs), recombinant proteins, vaccines (prophylactic and therapeutic, but excluding dendritic cell therapies and nucleic acid-based vaccines), next-generation agents, and others (for agents unclassifiable into the aforementioned categories) or not available (for agents unclassifiable due to insufficient information). For next-generation agents, nine subgroups were identified, including cell therapies, bispecific or multi-specific antibodies, antibody–drug conjugates (ADCs), gene therapies, oncolytic viruses, nucleic acid-based therapies, proteolysis-targeting chimeras (PROTACs), nucleic acid-based vaccines and other next-generation drugs. The origins of drugs were categorized as discovered in-house or in licensed. Products developed in-house could additionally be classified into the out-licensed group. Indications were grouped into therapeutic areas such as oncology (including haematologic cancers), infectious diseases, endocrine and metabolic diseases, autoimmune and immunologic diseases, cardiovascular diseases, neurologic diseases, gastrointestinal diseases, respiratory diseases, psychiatric diseases, dermatologic diseases, ophthalmologic diseases, haematologic diseases (non-oncology) and others (including therapeutic areas featuring fewer than 20 products, such as otologic diseases).Regarding innovation level, therapies were classified into three groups: first-in-class, fast follower and me-too, based on their targets, mechanisms of action (MoAs) and the most advanced development stages compared to global counterparts. Drugs with novel targets or novel MoAs were defined as either first-in-class or fast-follower based on whether or not they have class-leading clinical development status worldwide, respectively. Drugs with the same targets and similar MoAs as already-approved drug classes were considered me-too. It is noteworthy that the innovation level of the same products can differ between 2021 and 2024, depending on the product’s R&D pace relative to similar products, the level of detail in information disclosure, and whether new mechanisms of action have been identified. For example, 32 me-too agents identified in 2021 were reclassified as first-in-class or fastfollower in the 2024 dataset due to the identification of novel mechanisms of action for these products. First-in-class products at the phase III or new drug application stage are listed in Supplementary Table 1.

Reference

1. Li G, Liu Y, Hu H, Yuan S, Zhou L, Chen X. Evolution of innovative drug R&D in China. Nat.

Rev. Drug Discov. 21, 553-554 (2022).

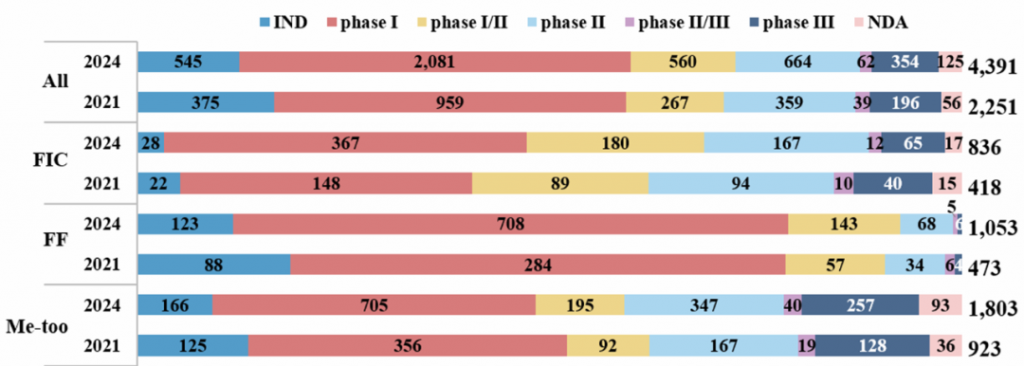

Supplementary Fig. 1 | Overview of most advanced development status of the investigational drug pipeline in China in 2021 and 2024 by innovation level. The products were grouped by innovation level (FIC, first-in-class; FF, fast-follower; me-too) and most advanced development status globally. IND, in the process of Investigational New Drug (IND) application; NDA, in the process of New Drug Application (NDA). Agents unamenable to classification into FIC, FF and me-too were only included in ‘All’ group.

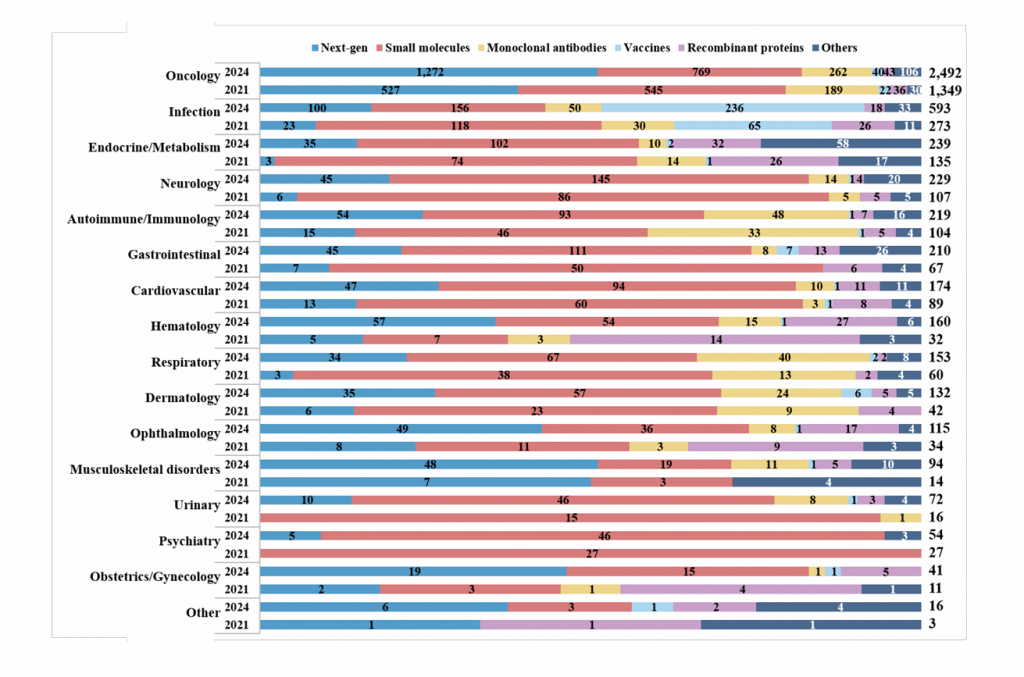

Supplementary Fig. 2 | Overview of agents with different product types by therapeutic areas. The agents were classified into five main groups: next generation agents (next-gen), small molecules, monoclonal antibodies, recombinant proteins, and vaccines. Those not aligning with these categories were placed in an ‘Others’ group. Additionally, these agents were grouped by various therapeutic areas. Therapeutic areas featuring fewer than 20 products, such as otology, and agents that could not be classified due to insufficient information or did not align with the main therapeutic areas, were grouped into an ‘Other’ category. A single drug product with multiple indications could be counted in more than one therapeutic area.

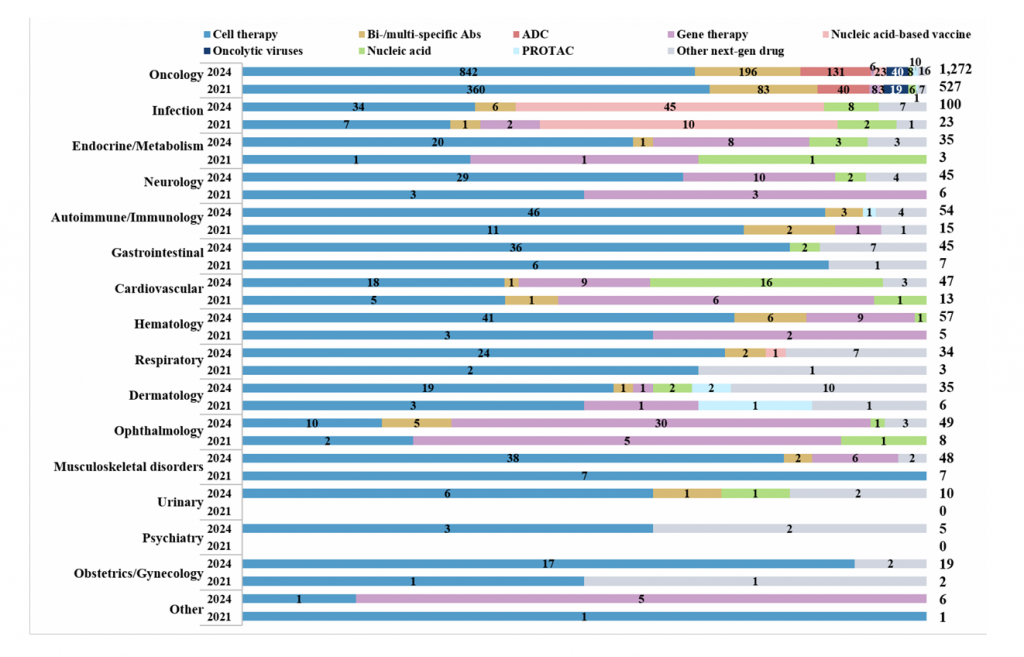

Supplementary Fig. 3 | Overview of next-generation agents by different therapeutic areas. The next-generation agents were classified into eight main groups (cell therapies, bi- or multi-specific antibodies (Abs), antibody–drug conjugates (ADCs), gene therapies, oncolytic virus, nucleic acid, proteolysis targeting chimeras (PROTACs) and nucleic acid-based vaccines). Those not aligning with these categories were placed in an ‘Other next-generation drug’ group. Additionally, these agents were grouped by various therapeutic areas. Therapeutic areas featuring fewer than 20 products, such as otology, and agents that could not be classified due to insufficient information or did not align with the main therapeutic areas, were grouped into an ‘Other’ category. A single drug product with multiple indications could be counted in more than one therapeutic area.

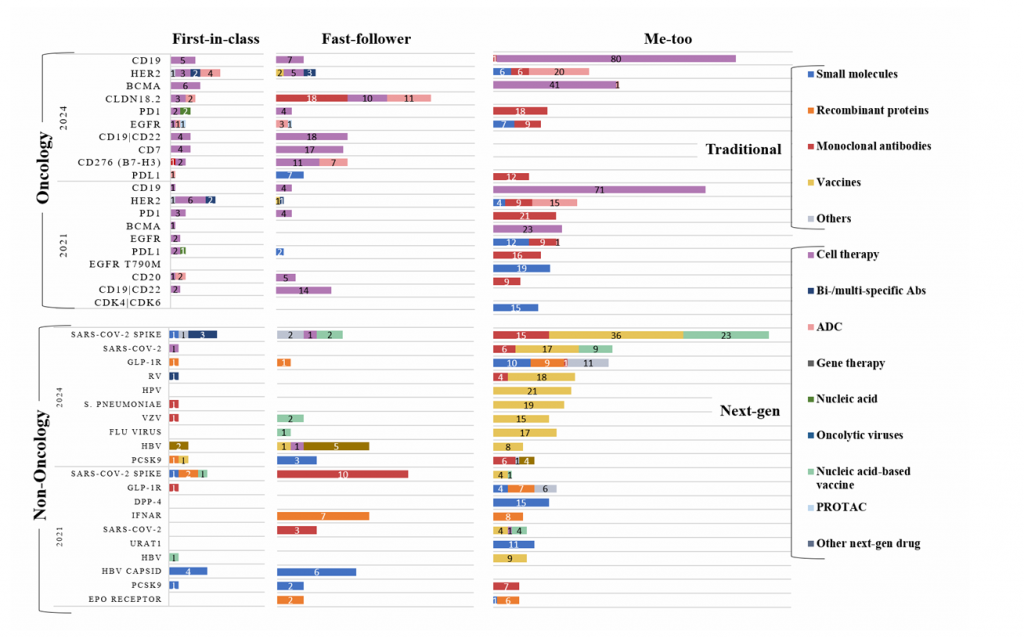

Supplementary Fig. 4 | Top ten targets of oncology and non-oncology agents in the investigational drug pipeline in 2021 and 2024. Agents were classified based on their innovation level as in Fig. 1 and by product type, and the figure is an expanded version of Fig. 2. Agents engaging multiple targets are indicated by a ‘/’ symbol (such as CD19/CD22). Ab, antibody; RV, rabies virus; HPV, human papilloma virus; HBV, hepatitis B virus; VZV, varicella-zoster virus; CD, cluster of differentiation; CDK, cyclin-dependent kinase; EGFR, epidermal growth factor receptor; HER, human epidermal growth factor receptor; PCSK9, proprotein convertase subtilisin/kexin type 9; PD1, programmed cell death 1; PDL1,programmed death-ligand 1; BCMA, B-cell maturation antigen; URAT1, urate transporter; DPP-4, dipeptidyl peptidase-4; S. pneumoniae, Streptococcus pneumoniae.

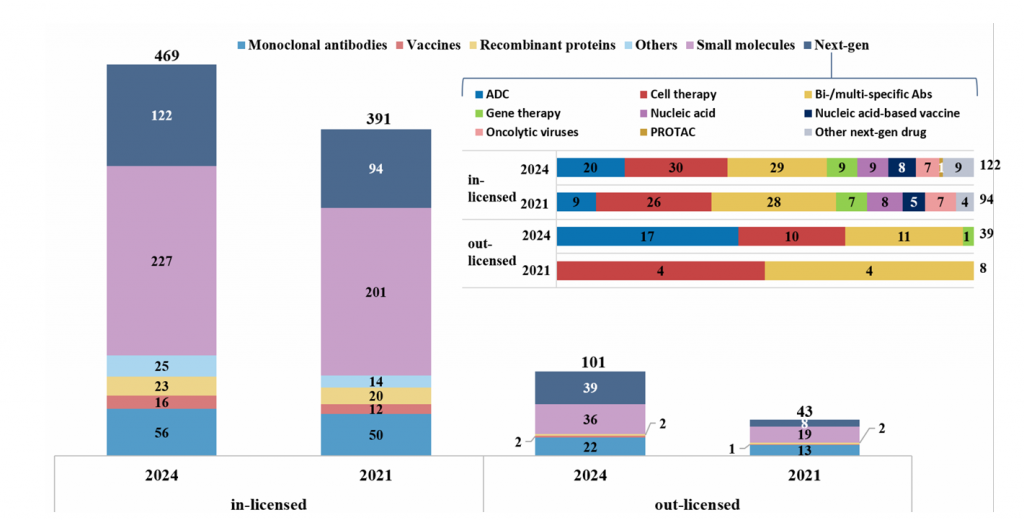

Supplementary Fig. 5 | Characteristics of in-licensed and out-licensed agents. The agents were classified into five main groups: small molecules,monoclonal antibodies (mAbs), recombinant proteins, vaccines, and next-generation agents (next-gen). Agents not fitting into the main groups were included in an ‘Others’ group. Subgroups of next-gen agents are depicted in doughnut charts, including cell therapies, bispecific or multi-specific antibodies, antibody–drug conjugates (ADCs), gene therapies, oncolytic virus, nucleic acid-based, proteolysis-targeting chimeras (PROTACs), nucleic acid-based vaccines and other next-generation drugs that do not fit into the aforementioned categories.

中国创新药研发趋势

7月31日,清华大学梁万年、李冠乔等合作在Nature Reviews Drug Discovery(IF=120.1)发表文章,对近年中国创新药研发趋势进行了分析。

在此将这篇文章分享出来,供大家参考:

为了阐明近年来中国药物研发的演变,作者概述了目前国内的创新药物,并将现在的数据,与其在2021年发表的一项分析进行了比较。

总体来说,如图1所示,截至2024年1月1日,中国药企在研的创新产品数量较2021年7月增加了近一倍(从2251个增至4391个)。

图1. 2021年和2024年中国在研药物管线概况,按产品类型和创新水平分类具体来说,如图2所示,first-in-class(FIC)产品(从418个增至836个,增长率100%)和fast-follow(FF)产品(从473个增至1053个,增长率123%)的增长率高于me-too产品(从923个增至1803个,增长率95%)。

图1. 2021年和2024年中国在研药物管线概况,按产品类型和创新水平分类具体来说,如图2所示,first-in-class(FIC)产品(从418个增至836个,增长率100%)和fast-follow(FF)产品(从473个增至1053个,增长率123%)的增长率高于me-too产品(从923个增至1803个,增长率95%)。

注:first-in-class指在相同作用机制药品中,研发进度处于全球第一梯队的产品 图2. 按创新水平划分的2021年和2024年中国在研药物开发情况

图2. 按创新水平划分的2021年和2024年中国在研药物开发情况

产品类型趋势

如图1所示,细胞疗法、基因疗法、双抗/多抗、ADC、PROTAC和核酸药物等下一代产品增长迅速,从613个增加至1709个(增长率179%),这使得下一代产品的比例从2021年的27%提高到了2024年的39%,超过了小分子药物的比例。下一代产品目前占据了FF管线(从35%上升到53%)和FIC管线(从52%上升到62%)的大部分。

在下一代产品类别中,细胞疗法继续占据主导地位,但其比例自2021年以来略有下降(从66%降至62%)。双抗/多抗和ADC位居第二、三位。以核酸为基础的产品增长最快,从24个增加到108个。

新靶点和靶点组合

靶点方面,2024年共有670个靶点(从2021年的375个增加了295个),其中包含220个肿瘤学靶点、349个非肿瘤学靶点、101个既能靶向肿瘤又能靶向非肿瘤的靶点。此外,新技术的应用增加了多靶点组合的数量(从2021年的207个增加到2024年的454个)。

如图3所示,对2021年和2024年TOP10的肿瘤学靶点进行分析发现,有7个靶点始终出现在两个列表中,其中CD19和HER2仍然是排名前两位的靶点。

图3. 2021年和2024年在研药物的TOP10靶点

图3. 2021年和2024年在研药物的TOP10靶点

虽然大多数靶向CD19的产品是细胞疗法,但靶向HER2的候选产品是基于多种技术平台。这种多样性使得HER2在FIC靶点中排名最高(图4)。CLDN18.2、CD7和CD276(B7-H3)等靶点的出现主要归因于细胞疗法和ADC等下一代技术。

图4. 2024年中国在研药物的TOP5靶点

对于非肿瘤性疾病,靶向SARS-CoV-2相关靶点的候选药物持续增加。此外,靶向GLP1R、GIPR和GCGR等靶点的药物正逐渐显示出改善第一代药物的前景。

对全球管线的贡献

自2021年7月以来,中国已有8款原研创新药物进入海外市场,其中7款已授权给国际合作伙伴。2024年有465款在研产品在国内/国外处于相同的研发阶段,这表明了全球同步研发的趋势。

此外,在2021年7月以来进入临床开发的2623种产品中,me-too产品的比例降至35%,而2021年管线中me-too产品的比例为50%,这表明中国医药行业正在向具有更高临床价值潜力的药物创新方向迈进。