Black Friday shoppers spent a record $9.8 billion in U.S. online sales, up 7.5% from last year

来源:cnbc | 发布时间:2023-11-28

摘要:Black Friday generated $9.8 billion in U.S. online sales, according to Adobe Analytics, up 7.5% from a year ago.The spending bump reflects consumers looking to advantage of big deal days and finding it easier to compare discounts online.After Cyber Monday, sales will likely taper off through the rest of the holiday season as retailers trim discounts.

Black Friday e-commerce spending popped 7.5% from a year earlier, reaching a record $9.8 billion in the U.S., according to an Adobe Analytics report, a further indication that price-conscious consumers want to spend on the best deals and are hunting for those deals online.

“We’ve seen a very strategic consumer emerge over the past year where they’re really trying to take advantage of these marquee days, so that they can maximize on discounts,” said Vivek Pandya, a lead analyst at Adobe Digital Insights.

Black Friday’s spending spike reflects a consumer who is more willing to spend than in 2022, when gas and food prices were painfully high.

Pandya noted that impulse purchases may have played a role in the Black Friday growth since $5.3 billion of the online sales came from mobile shopping. He noted that influencers and social media advertising have made it easier for consumers to get comfortable spending on their mobile devices.

Still, shoppers are price-sensitive, managing tighter budgets due to last year’s record inflation and interest rates. According to the Adobe survey, $79 million of the sales came from consumers who opted for the ‘Buy Now, Pay Later’ flexible payment method to stretch their wallets, up 47% from last year.

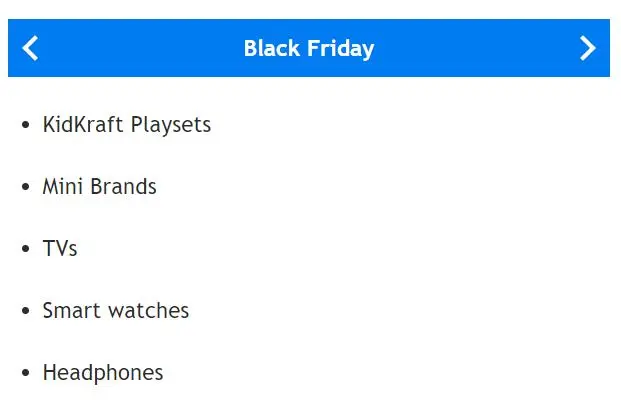

The best-selling categories of Black Friday, the Adobe report found, were electronics like smartwatches and televisions, along with toys and gaming. Meanwhile, home-repair tools underperformed. Pandya said top sellers directly correlated to whichever products had the best discounts.

Adobe gathers its data by analyzing one trillion visits to U.S. retail websites, 18 product categories and 100 million unique items. It does not track brick-and-mortar retail transactions.

A Mastercard analysis of this year’s Black Friday sales found that in-store sales rose just over 1% versus online sales, which grew by over 8% compared to last year.

“I do think the paradigm has changed around the in-store Black Friday experience, the long lines and things like that,” said Adobe’s Pandya.

Consumers are “more in the driver’s seat” when they are online shopping, he added, because it is easier to make side-by-side price comparisons and secure a better price.

Retailers are aware of the rise of deal-hunting consumers and want to capture as many of them as possible. Companies like Best Buy

and Lowe’s

have both announced higher discounting levels. Other retailers like Target

and Ulta Beauty

have rolled out pop-up promotions that offer 24-hour discounts on certain brands and items.

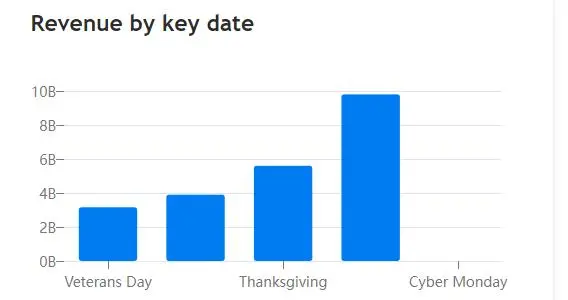

Black Friday kept the momentum going from the day before on Thanksgiving when online sales totaled $5.6 billion, according to a prior Adobe analysis.

Adobe expects the spending strength to hold over the weekend and through Cyber Monday with the biggest bargains still ahead. The report forecasts that online shoppers will spend roughly $10 billion over the course of Saturday and Sunday, and a record $12 billion on Cyber Monday.

But spending will likely begin to taper off deeper into the holiday season, according to Pandya. Cyber Monday, as the last major deal day of the holiday season, could be the final spending spike on non-essential goods for the rest of the year.

“We do expect growth to weaken because those discounts will weaken and they are dictating a lot in terms of buyer behavior this season,” said Pandya.

He noted that there are always gift-givers who procrastinate their holiday shopping so spending could continue to trickle in late into December. But the real growth surges, he said, “end up being in November and Thanksgiving week.”

当疯抢便宜货的美国人引爆“黑五”:美国经济真的岁月静好吗?

在今年的这个“黑五”购物节里,美国消费者和零售商们,似乎都为之疯狂了……

一边是商家为了吸引客户,只能靠实打实的“跳楼价”、“骨折价”竞相降价内卷;而另一边则是长期饱受高通胀之苦、始终捂紧钱包的消费者,终于盼来了假日季打折的“黄金窗口”,等到了更大力度的商品折扣,从而开始大肆消费。于是乎,人们也由此看到了一个前所未有的“黑色星期五”线上销售高峰……

根据美国电商研究机构Adobe分析上周六发布的数据显示,仅“黑色星期五”这一天,美国购物者在网上就花费了创纪录的98亿美元,较去年大幅增长7.5%。电子商务平台Shopify周末也报告了创纪录的全球销售额——该平台今年“黑五”销售总额超过了40亿美元,比去年高出了22%。

火热“黑五”下的“消费降级”

在通胀持续、政府刺激金几乎耗尽的背景下,选择更便宜的商品眼下似乎正成为美国消费者的首要诉求。

全球资讯巨头麦肯锡的一项研究发现,近80%的消费者希望在今年的假日购物中“消费降级”,将计划购买的商品换成更便宜的替代品,不然就干脆放弃购买。

而最新火爆的“黑五”销售数据背后,其实恰恰也便是商家被迫大降价、消费者得以心满意足的结果——消费者们宁可在过去几周乃至几个月压抑自身的消费需求,只等待“黑五”假日促销季的窗口来临。

据美国全国零售联合会称,预计将有超过1.82亿人在“黑色星期五”和“网络星期一”销售期间购物,比去年增长9%,创下自2017年开始追踪以来的新高。

Adobe的报告发现,“黑五”最畅销的商品是智能手表、电视等电子产品,以及玩具和游戏。该机构分析师Vivek Pandya表示,而这些最畅销的产品恰恰与折扣最大的产品直接相关。

Adobe统计黑五当天最热门五类商品,分别是:KidKraft玩具套装、Mini Brands系列玩具、电视机、智能手表和耳机。

根据Adobe Analytics的数据,今年“黑五”的线上商品折扣力度比一年前要更大,尤其是玩具和服装。其中,玩具平均折扣达到28%,而去年同期为22%;电子产品平均折扣幅度为27%,而去年同期基本持平。在服装方面,购物者看到了平均24%的折扣,远高于去年的19%。

Salesforce零售业务副总裁兼总经理Rob Garf指出,黑色星期五强劲的在线销量表明,购物者正投入更多时间和精力来精挑细选成本最低、性价比最高的商品,该公司跟踪流经其商务云的电子商务服务数据。

Garf指出,“尽管今年零售商的假日促销活动较早开始,但最初并没有很多优惠。然而,消费者很有耐心,很勤奋,他们玩了一场等待打折的游戏。而最终他们赢了。”

安永首席经济学家Gregory Daco在一份报告中表示,尽管10月份通胀有所降温,但“成本疲劳”的看法依旧存在,这抑制了早些时候消费者的消费欲望。成本疲劳是指消费者认为一切成本都高于疫情前的看法。

商家纷纷在打折潮中陷入“内卷”

从商家层面来看,美国零售商其实很早就已经在为迎接一个充满挑战的假日季做准备。此前公布的数据显示,10月美国零售销售额环比下滑0.1%,这是近7个月来首次下降。

不少高管们表示,在经过两年疫情刺激的消费潮后,美国零售商们如今面对的是更为精挑细选的消费者,越来越多的美国消费者希望在价格最优惠的时候进行购买,并且更为热衷于在网上而非线下寻找这些优惠。而零售商所能做的,只能是在今年的打折季中以更大的降价力度,来适应这一转变。

最终,人们无疑可以看到,百思买、劳氏等大多数零售商的折扣力度均高于以往,Target、美妆零售巨头Ulta Beauty等零售商则推出了闪购促销活动,甚至为某些品牌和商品提供24小时折扣。

梅西百货首席执行官Jeff Gennette)本月向投资者表示,从梅西百货到亚马逊,零售商早在10月份就推出了促销活动,并可能在临近圣诞节时再提供额外折扣。

特价商品反映出零售商之间的激烈竞争,他们在吸引美国消费者方面面临着巨大的压力,这些消费者对许多商品依然居高不下的通胀率感到厌倦。“人们更加注重性价比,”宾夕法尼亚大学沃顿商学院教授芭芭拉·卡恩说。“人们正在消费,但他们的消费已变得更加保守。”

GlobalData董事总经理Neil Saunders表示,“购物者正寻找他们真正想要和需要的商品,而不是简单地冲动地购买很多东西。这对零售商来说不一定是好事。”

事实上,尽管商家“诚意满满”,但不少消费者还是对价格颇为敏感,并且手头上也已颇为拮据,越来越多消费者选择了“先买后付”的交易方式。Adobe调查显示,“黑五”期间,约有7900万美元的销售额来自选择“先买后付”的方式支付的消费者,比去年增长了47%。

美国经济真的岁月静好吗?

回顾今年美国的零售销售情况不难发现,消费者今年的花钱速度与过去几年不同,彼时消费的特点是疫情过后的大肆挥霍。

但锁定美国中上阶层的零售业者,近来销售数据出现了两年来的最大跌幅。美国经济仰赖消费力道抵御衰退。通常,富裕的购物者往往对消费支出产生巨大影响,不仅因为他们在经济强劲时有钱挥霍,还因为当经济承压时,他们也会更快地减少支出。但较富有的美国人,在今年黑色星期五的购物旺季前夕减少了花费,这本身反而可能是令人忧心的征兆。

彭博此前创建过一个富裕指数,用来代表高收入阶层的支出水平,其中涵盖10个类别的30家大型零售商和品牌。自一月份以来,该指数中的零售商和品牌销售表现大幅下降,而且最近进一步恶化。8月至10月的三个月内,70%的公司销售额下降,中值下降了14%,这是两年来最差的表现。

百思买首席执行官Corie Barry近期表示:“在最近的宏观环境中,消费者需求更加不均衡,难以预测。”

消费占到了美国经济的70%以上。目前,尽管黑五销售数据火爆,但一个较为令人感到担心的风险是,消费者是否会趁着本轮促销季的降价,提前透支了自己未来的预算?这样的消费热度是否能持续?随着家庭支出增速压力进一步显现,美国GDP增长拐点仍可能到来。

目前,美国个人储蓄正从疫情时期的高点回落,虽然通胀率正在放缓,但许多物品的价格仍然比几年前明显更高。利率上升也推高了房价和车价,消费者不得不有所取舍。

同时,随着超额储蓄逐渐被消耗,美国人也正越来越依赖信用卡进行消费。纽约联储早前公布的第三季度家庭总债务水平报告发现,信用卡总债务已达到了达到1.08万亿美元。而由于美联储大幅加息,借款人的成本也正在显著增加:美国平均信用卡年利率已经突破20%,也可能成为潜在逆风。

不难预见到的是,美联储接下来如何逐步退出紧缩周期,很可能也将取决于一系列商业活动和消费需求反馈出的信息。

如果“黑五”的火热数字是美国消费复苏的真实写照,那么美联储无疑仍将保持一个相对鹰派的基调;但如果假日季的火热只是如昙花一现般的惊鸿一瞥,反而导致未来零售数据大幅降温,那么人们对于软着陆前景是否能成立的担忧,无疑也将随之升温。

当然,万事达卡经济研究所美国首席经济学家Michelle Meyer目前仍相对乐观。

Meyer表示,经历近年混乱的购物体验之后,消费者也算是在回归更正常的购物节奏。她在接受采访时表示,今年的销售预测表明正“回归到更加均衡的经济”,美国失业率仍然很低,消费者还有消费能力。