The R&D landscape for infectious disease vaccines

来源:Nature Reviews Drug Discovery | 发布时间:2023-07-25

Vaccines have a tremendous impact on public health, and their importance has been emphasized by the COVID-19 pandemic. Here, we provide an overview of the current state of research and development (R&D) on prophylactic vaccine candidates for infectious diseases globally.

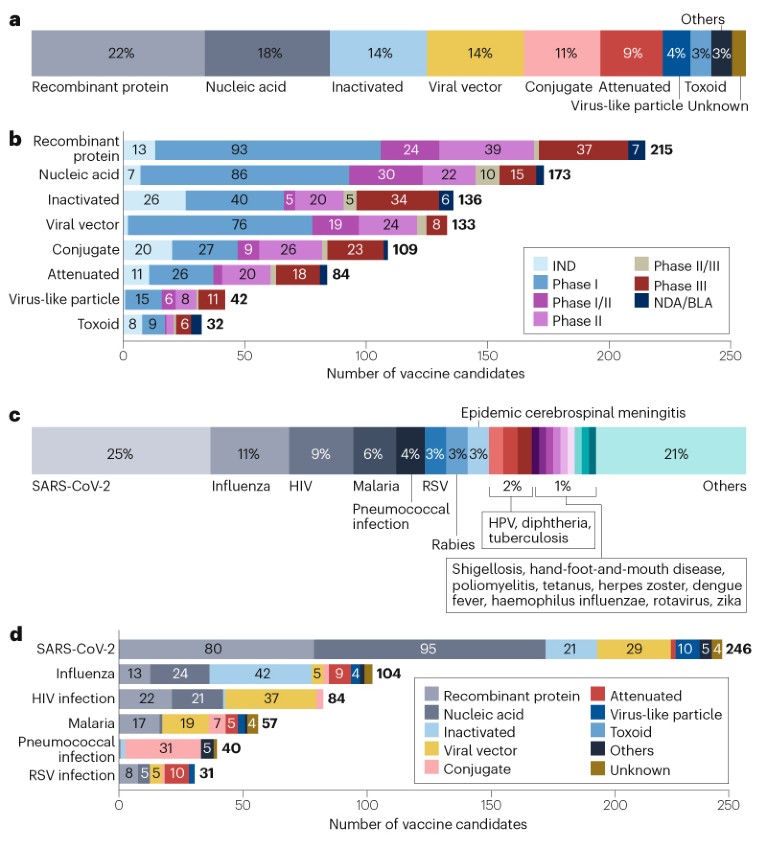

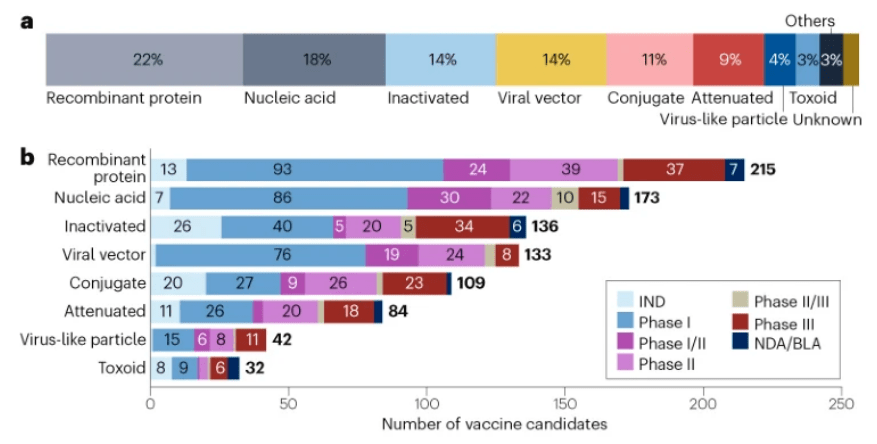

Technology platforms

As of 1 January 2023, the global vaccine R&D landscape includes 966 candidates, among which 23% (220) are traditional inactivated or attenuated vaccines (Fig. 1a,b). Advances in molecular technologies have led to the development of other platforms, such as recombinant protein vaccines, nucleic acid vaccines and viral vector vaccines, which have further diversified the pipeline.

Recombinant protein vaccines account for the largest proportion of the pipeline at 22% (215 candidates; Fig. 1a,b), supported by their well-understood safety profile, stability and ease of manufacturing. Almost 100 recombinant vaccine candidates are in phase I development, the highest number at this stage among all the platforms.

The successful launch of SARS-CoV-2 mRNA vaccines has built momentum for nucleic acid vaccine platforms, which include RNA and DNA vaccines. Such platforms now make up the second largest segment of the overall pipeline, at 18% (173 candidates; Fig. 1a,b). Owing to the flexibility of these platforms in developing vaccine candidates for pathogens with high variability in the target antigens, many of these candidates are being developed for such pathogens, including SARS-CoV-2 (95 candidates), influenza (24 candidates) and HIV (21 candidates).

Viral vector vaccines (133 candidates; 14%; Fig. 1a,b) have also garnered attention in recent years, owing to their potential to induce robust and durable immune responses. Various types of viral vectors are being used, including adenoviruses, retroviruses, lentiviruses and poxviruses. In particular, adenoviral vectors (82 candidates) have been widely applied in the development of vaccines for diseases including Ebola, HIV, influenza and SARS-CoV-2. To circumvent the limitation of pre-existing immunity to adenovirus type 5 (Ad5), versatile adenoviral serotypes have been developed, such as Ad26, Ad35 and Ad11.

Conjugate vaccines, which are the next largest group (109 candidates; 11%; Fig. 1a,b), have often been developed against pathogens such as meningococcus, pneumococcus and haemophilus influenzae. These vaccines are based on covalent linkage of immunogenic protein carriers (mostly tetanus toxoid, diphtheria toxoid or group B meningococcal outer membrane protein) to capsular polysaccharides or peptides to enhance immunogenicity and stability.

Diseases

The top three diseases for vaccine development are all caused by viruses: SARS-CoV-2 (246 candidates; 25%), influenza (104 candidates; 11%) and HIV (84; 9%) (Fig. 1c,d; Supplementary Fig. 1).

SARS-CoV-2. In addition to over 50 vaccines that have received market approval or emergency use authorization (not included in this analysis), another 64 candidates had entered phase III or had a regulatory application submitted, of which 47% were mRNA vaccines. In the current pipeline, at least 14 nasal vaccines are in development, which are expected to stimulate immunity in the respiratory mucosa and reduce transmission.

HIV infection. The high variability of the viral genome and the high level of glycosylation of the HIV envelope glycoprotein (gp), which often induces immune evasion, have hindered the development of successful HIV vaccines. However, there is hope of stimulating the production of broadly neutralizing antibodies (bnAbs) by targeting conserved regions of envelope proteins with little variation between HIV strains, such as gp160, gp41 and gp120. Novel platforms such as viral vectors and mRNA offer a promising avenue for HIV vaccine development. For example, two mRNA vaccines to induce the production of bnAbs are now in a phase I trial (NCT05001373).

Influenza. In contrast to the dominance of novel technologies in HIV vaccine development, 40% of influenza vaccine candidates were inactivated vaccines (Fig. 1d). Given the variety of influenza subtypes from antigenic drift, universal vaccines are being increasingly developed to reduce the need for frequent vaccination. The vaccines were designed based on highly conserved epitopes in the viral haemagglutinin, neuraminidase or other proteins. At the time of analysis, six universal influenza vaccine candidates were in phase III trials.

Other diseases. Beyond the three diseases above, there are a substantial number of vaccines being developed for respiratory syncytial virus (31 candidates; 3%), supported by recent breakthroughs in targeting stable pre-F proteins. Notably, two recombinant protein vaccines, PF-06928316 and GSK3844766A, resulted in >80% protection in phase III trials, and received FDA approval in 2023, after the cut-off date for the analysis. An mRNA vaccine (mRNA-1345) has received breakthrough therapy designation from the FDA after also showing >80% protection in a phase III trial.

Non-viral pathogens such as malaria (57 candidates; 6%) and pneumococci (40 candidates; 4%) also represent a significant area of interest (Fig. 1c,d). Conjugate vaccines are the primary focus for pneumococcal bacteria, while recombinant proteins and viral vectors are the main platforms for malaria vaccines. Vaccines are also being developed to prepare for potential future outbreaks of diseases such as Ebola.

R&D distribution

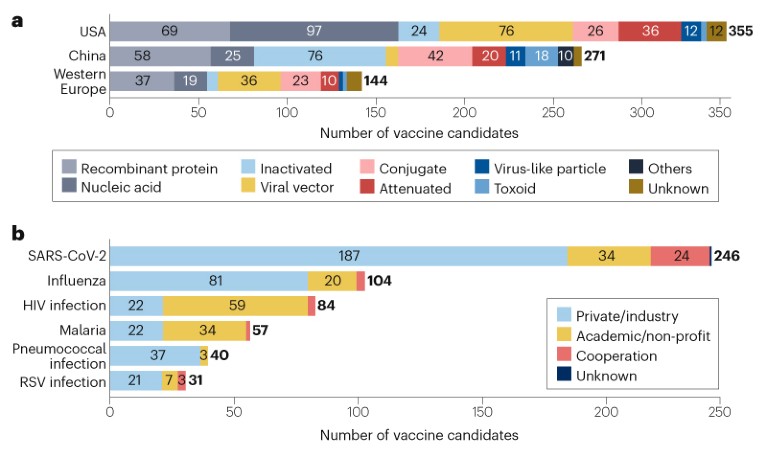

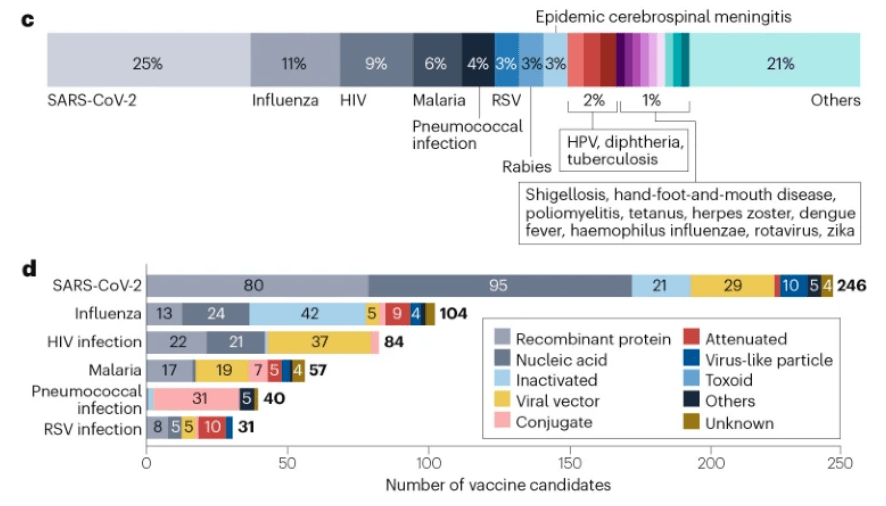

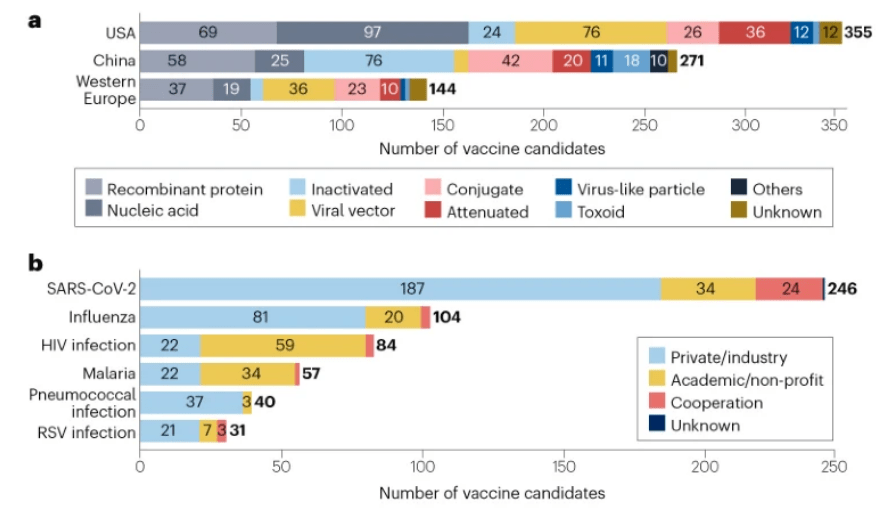

Vaccine R&D is mainly concentrated in the USA (355 candidates), China (271 candidates) and western Europe (144 candidates) (Fig. 2a), in part due to their strong R&D capabilities and regulatory policy support. Some differences in technology platform preferences have been observed in these regions; the US pipeline features more nucleic acid vaccines, whereas the pipeline in China has more inactivated vaccines and fewer viral vector vaccines than the USA and western Europe. The majority (68%) of the candidates are being developed independently or collaboratively by private companies/industry, while 25% are being developed by academic or other non-profit organizations (Fig. 2b). Notably, candidates against HIV and malaria are being developed mostly by academic or other non-profit organizations.

Outlook

The success of vaccine development relies heavily on the identification of effective antigens and the use of appropriate technology platforms. In addition, international collaboration and coordinated efforts are crucial to efficiently achieve these goals. The COVID-19 pandemic has highlighted the importance of global cooperation in addressing public health emergencies, and has demonstrated the potential benefits of sharing resources and expertise to accelerate vaccine development and deployment. This includes sharing scientific resources and expertise, collaborating on R&D, and establishing coordinated mechanisms for outbreak preparedness and response.

全球传染病疫苗研发格局:966款候选疫苗,重组蛋白类占比22%

01/ 技术平台

截至2023年1月1日,全球疫苗研发领域包括966种候选疫苗,其中23%(220种)是传统的灭活疫苗或减毒疫苗。分子技术的 进步加速了重组蛋白疫苗、核酸疫苗和病毒载体疫苗等其他平台的发展,使得全球疫苗管线更加多样化。

具体来说,新型疫苗中占比最大的是重组蛋白疫苗,为22%(215种) ;其次是核酸疫苗,占18%(173种);随后是病毒载体疫苗和结合疫苗,两者分别占比 14%(133种)和 11%(109种)。

相比与其他类型的疫苗,重组蛋白疫苗在安全性、稳定性和易制造性方面更有优势,目前有93款重组蛋白疫苗处于临床I期阶段,是I期管线最多的疫苗类型。

核酸疫苗包括RNA疫苗和DNA疫苗,新冠疫情推动了该类疫苗的发展。核酸疫苗在开发具有高度变异性的病原体疫苗方面具有灵活性,目前该类在研疫苗包括95款新冠候选疫苗、24款流感候选疫苗和21款HIV候选疫苗。此外,还有针对癌症开发的癌症核酸疫苗在研。

病毒载体疫苗具有诱导强大而持久的免疫反应潜力,目前使用的病毒载体类型包括腺病毒、逆转录病毒、慢病毒和痘病毒。其中,腺病毒载体 类疫苗有82款,被广泛用于包括埃博拉、HIV、流感和新冠肺炎等疾病疫苗的开发。另外,为了 规避对5型腺病毒(Ad5)已有免疫力的限制,现在已开发出了 如Ad26、Ad35和Ad11在内的多种腺病毒血清型。

结合疫苗的开发主要是针对脑膜炎球菌、肺炎球菌和流感嗜血杆菌等病原体。该类 疫苗基于免疫原性蛋白质载体(主要是破伤风类毒素、白喉类毒素或B群脑膜炎球菌外膜蛋白)与荚膜多糖或肽的共价偶联,来增强免疫原性和稳定性。

02/ 疾病类型

从疾病类型看,位列研发数量前三的疫苗依次是新冠疫苗(246种,25%)、流感疫苗(104种,11%)和HIV疫苗(84种,9%) ,且这三类疾病均是由病毒引起的。

新冠疫苗目前已有50多种获批上市或获得了紧急使用授权,另外有64种新冠候选疫苗已进入临床Ⅲ期或已提交了上市申请,这其中有47%为mRNA疫苗。此外,现至少有14种鼻腔疫苗处于研发中。

现阶段 40%的流感疫苗属于灭活疫苗。鉴于抗原漂移导致的流感亚型的多样性,越来越多的研发机构基于病毒血凝素、神经氨酸酶或其他蛋白质中高度保守的表位设计,在开发通用疫苗以降低接种频次。目前, 已有6种通用流感候选疫苗进入Ⅲ期临床试验阶段。

HIV疫苗的开发难点在于免疫逃避问题。HIV 病毒基因组的高度变异性和HIV包膜糖蛋白(gp)的高水平糖基化往往会诱发免疫逃避,但现在 人们希望通过靶向包膜蛋白的保守区来刺激广谱中和抗体的产生,这些包膜蛋白在HIV毒株之间差异很小 ,如gp160、gp41和gp120。而 病毒载体和mRNA等新型技术 有望促进HIV疫苗的开发,如目前 两种能够诱导中和抗体产生的mRNA疫苗正处于I期试验阶段(NCT05001373)。

除了上述三种疾病疫苗外,还有许多针对其他疾病的疫苗在研项目,如RSV疫苗(31 种,3%)、疟疾疫苗(57 种,6%)和肺炎球菌疫苗(40 种,4%) 等。就RSV疫苗而言, 最近在靶向稳定的pre-F蛋白方面取得了突破,两种重组蛋白疫苗PF-06928316和GSK3844766A在III期试验中产生了>80%的保护作用,并在今年相继 获FDA批准。另Moderna的mRNA疫苗(mRNA-1345)在III期试验中也显示出>80%的保护作用,并已获FDA授予的突破性疗法。

至于疟疾疫苗和肺炎球菌疫苗,前者的主要平台技术是重组蛋白和病毒载体,后者的主要关注点则是结合疫苗。

03/ 研发地区和机构

不同地区的研发技术平台能力和监管政策等有差异。目前, 疫苗研发主要集中在美国(355 种)、中国(271 种)和西欧(144 种) 。其中,美国的管线以核酸疫苗为主,中国的管线则以灭活疫苗为主,病毒载体疫苗较少。

从机构类型看, 68%的候选疫苗由私营企业独立或合作开发,25%的由学术组织或其他非营利组织开发。值得注意的是,针对HIV和疟疾的候选疫苗主要由学术组织或其他非营利组织开发。

04/ 前景展望

疫苗开发的成功在很大程度上取决于有效抗原的识别和适当技术平台的使用。此外,国际合作和协调努力对有效地实现这些也目标至关重要。COVID-19大流行反映了全球合作在应对突发公共卫生事件方面的重要性,同时也显示出了共享资源和专业知识在加速疫苗开发和部署方面的潜在好处。总之,全球应该建立一套共享科学资源和专业知识、合作研发、疫情准备和响应的系统协调机制。