Nvidia to get 20% weighting and billions in investor demand, while Apple demoted in major tech fund

来源:CNBC | 发布时间:2024-06-19

Nvidia’s blistering rally will force a major technology exchange-traded fund to acquire more than $10 billion worth of shares of the chip giant while cutting dramatically back on Apple.

The index that the Technology Select Sector SPDR Fund (XLK) follows will soon rebalance, based on an adjusted market cap value from Friday’s close. The new calculations show Microsoft as the top stock in the index, followed by Nvidia and then Apple, according to Matthew Bartolini, head of SPDR Americas Research.

All three stocks would have a weight above 20% in the index if there were no caps in place. But diversification rules for the index limit how big the cumulative weight of stocks with at least a 5% share of the fund can be.

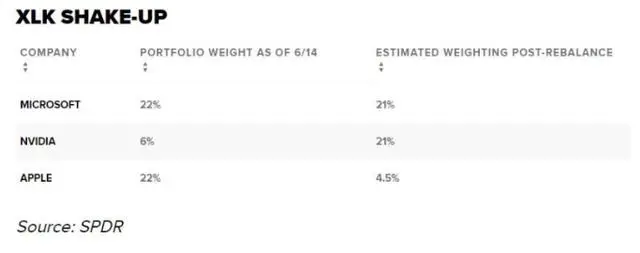

As a result, Microsoft and Nvidia will likely have a weight of around 21%, while Apple will fall sharply to about 4.5%, Bartolini said.

That is a change from the prior weightings, which saw Nvidia’s weight be kept artificially low by index rules. As of June 14, Microsoft and Apple were both at about 22% each in the fund, while Nvidia was just 6%.

XLK SHAKE-UP COMPANY PORTFOLIO WEIGHT AS OF 6/14 ESTIMATED WEIGHTING POST-REBALANCE

MICROSOFT 22% 21%

NVIDIA 6% 21%

APPLE 22% 4.5%

Source: SPDR

The race to finish in the top two came down to the final day. As of Monday, market cap data from FactSet shows that all three companies are over $3.2 trillion and within $50 million of each other, though that data does differ slightly from the calculations used in the index.

The XLK has about $71 billion in assets under management, so a 15-percentage-point change in the fund equates to more than $10 billion. SPDR does not comment on specific trading strategies around rebalances.

The big shift in the XLK is an extreme example of how even passive index funds can diverge, especially when focusing on narrow slices of the market.

“Understanding how they might be weighted, where they’re allocated, what the rebalance frequency is, is really important because it can create differences in exposures and make what’s beneath the label seem different from fund to fund,” Bartolini said.

The fund follows the Technology Select Sector Index from S&P Dow Jones Indices, which uses a float-adjusted calculation to determine market cap. The rebalance officially takes effect at the end of this week.

The free-float adjustment for market cap accounts for large holders of an individual stock unlikely to be trading on a daily basis. For example, Warren Buffett’s Berkshire Hathaway owns more than 5% of Apple, which could count against it in the index, Bartolini said.

“Its free-float market capitalization is reduced because you have so many controlled interests in the company,” Bartolini said.

The rebalance will be in effect for one quarter, even if Apple outperforms Nvidia significantly ahead of the official date.

On Monday, shares of Apple were up 2%, while Nvidia dipped 0.7%.

全球最有影响力的科技指数权重调整:苹果降至4.5%,英伟达升至21%

英伟达的大幅上涨,将迫使一家大型科技ETF 提高该公司在基金中的权重,同时大幅降低苹果的权重。

标普科技精选行业指数(XLK)根据上周五收盘时调整后的市值,后续将很快重新平衡。SPDR 美国研究的负责人Matthew Bartolini表示,调整完成之后,微软是该指数的第一大标的,其次是英伟达,然后是苹果。

Matthew Bartolini 表示,因此,微软和英伟达的权重可能会在21%左右,而苹果的权重将大幅下降至4.5%左右。

这与之前的权重有所不同,此前英伟达的权重被指数规则压低。截至6月14日,微软和苹果在该基金中的份额均约为22%,而英伟达仅为6%。

周一收盘后,微软、英伟达和苹果三家公司的市值都超过3.2万亿美元。

标普科技精选行业指数基金管理着约710亿美元的资产,因此一个标的在该基金15个百分点的权重变化,相当于超过100亿美元投资规模。SPDR称,将不对围绕再平衡的具体交易策略发表评论。

标普科技精选行业指数基金的巨大转变是一个极端的例子,说明即使是被动指数基金也会出现分歧,尤其是当前美股涨势相当集中。

Matthew Bartolini 解释称:“了解它们的加权方式、分配位置、再平衡频率是什么,这一点非常重要,因为这会造成风险敞口的差异,并使标签下的内容看起来因基金而异。”

标普科技精选行业指数基金,跟踪标准普尔道琼斯指数中的技术选择行业指数,该指数使用浮动调整计算来确定市值。标普科技精选行业指数权重调整将于本周末正式生效。

标普科技精选行业指数基金称,标的权重调整后的状态将持续一个季度。